Political Disbursements

Disbursements are entered in much the same way as receipts.

After choosing a Individual, Organization or Vendor from the main screen, click on the Payments button. You'll then see the disbursement entry window, with all of the account's prior entries, if any, displayed on a grid.

To edit a prior entry, double-click on the entry and it will appear with all its details in the lower part of the window.

To add a new entry, you must first choose a disbursement code. Either enter the code or click on the description to look it up. Once you've entered the code or description, click on the amount field. You will notice that a number of defaults are automatically entered: the description, today's date, receipt type, form, political categories and account. These are the defaults that have been established (in the committee setup section of the program).

Any of these defaults can be overwritten. For example, to change the description, click on the Desc button and enter something other than the default.

Disbursement Types

In most cases the Type field will default to PD for Political Disbursement. Here are the other types that can be entered:

TO Transfer to other Cmtes

MD Monetary Disbursement

RC Returned Contribution

CC Credit Card CHARGE

CP Credit Card PAYMENT

M Memorandum Entry

LO Loan

FL Forgiven Loan

3P Third Party Payment

TK Ticket Purchase

DB Debt

RF Refund

IN Interest

OT Other

Credit Card Payments

You can enter credit card payments and retain the detail of the items covered by your payment to the credit card company.

First you make the payment to Vendor record that represents your credit card company. The Type should be either PD or CP (card payment).

After the disbursement has been entered, click on Memos. This will open up an entry screen where you can enter an unlimited number of transactions up to a sum not exceeding the amount of the payment recorded. For each transaction, you'll enter the payee, disbursement code, date and amount.

It is not requred that the sum of items equal the amount of the original disbursement, so don't worry about entering every transaction. However, the FEC requires that you itemize every payee who's received $200 or more during the calendar year, so if you think you'll exceed that threshold with a particular vendor, enter the amount, no matter how small.

Click Save when you're finished. You'll notice on the disbursement entry screen a statement that says x number of memo entries are attached.

When you generate your FEC report, these entries will appear as memos, which means they won't figure in the disbursement totals. Memo entries made to vendors who haven't been paid the $200 threshold will be left off the report.

Expense Reimbursements

Many election authorities (including the FEC) require the itemization of reimbursements when they are for payments made to vendors who are receiving a certain aggregate amount within the election cycle or calendar year. (In the FEC's case it's $200 for the year.)

Before entering the reimbursement, make sure that all vendors to be itemized, i.e. "Hampton Inn" or "United Airlines" or "Shell Oil", have been added to your Vendor database with their complete addresses.

Next, go to the Data File Maintenance screen, call up the individual and click Disbursements.

Enter the the payment to the individual. The Type should be PD (which is usually the default).

After the disbursement has been entered, click Memos. This will open up an entry screen where you can enter an unlimited number of transactions up to a sum not exceeding the amount of the payment recorded. For each transaction, you'll enter the payee, disbursement code, date and amount.

It is not requred that the sum of items equal the amount of the original disbursement, so don't worry about entering every transaction. However, if you think you'll exceed the minimum threshold with a particular vendor, enter the amount, no matter how small.

Click Save when you're finished. You'll notice on the disbursement entry screen a statement that says x number of memo entries are attached.

When you generate your FEC report, these entries will appear as memos, which means they won't figure in the disbursement totals. Memo entries made to vendors who haven't been paid the $200 threshold will be left off the report.

Contribution Refunds

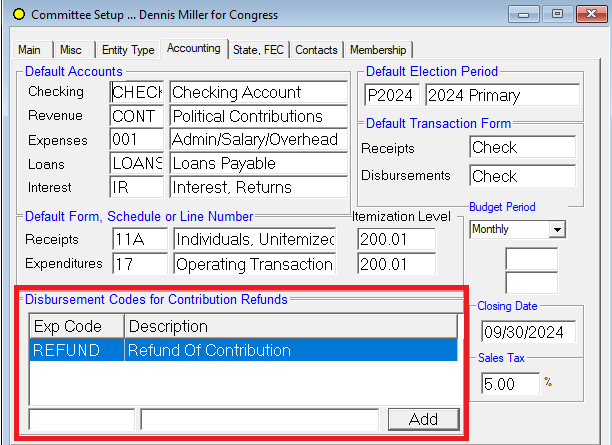

1. Establish the disbursement code. Go to Data File Maintenance->Support Codes->Disbursement codes. Enter the disbursement code that you'll use for contribution refunds. Enter the appropriate Form, Schedule or Line number. (For federal candidates the line number is 20A.).

2. Identify the disbursement code as a refund. Go to Setup->Committee->Accounting. Enter the code in one of the slots in the section marked Disbursement Codes for Reimbursements.

3. Enter the refund as a disbursement, making sure the refund is made to the same person or PAC for which the donation is recorded.

Debts and Payables

Enter the debt or payable as a disbursement. The Type should be DB. Save it.

Repayment of Loans, Debts and Payables

Enter a disbursement to the same payee to whom the debt was posted. Enter the appropriate type, form and check number. In the Apply To section, use the F3 key or the up/down arrows to find the debt. Save it.

In-Kind disbursements on behalf of Federal candidates or committees

1. Ensure that the Candidate Info has been filled in for the appropriate candidate or committee. That means going to the second tab of the master file entry screen, checking Federal Candidate and entering the Candidate ID number (begins with H, S or P --- not the committee ID, which begins with C00), name, state, district and office sought.

2. Enter the disbursement to the appropriate vendor.

3. With the disbursement item is in the entry area, click Log and then Candidate Info. Call up the candidate's name or committee; the candidate info should auto-fill. Then Save.

When the FEC report is generated, this disbursement will be noted as a disbursement on behalf of the named candidate.

Independent Expenditures to Federal Candidates

The first step is to ensure that the Candidate Info has been filled in for the appropriate candidate or committee. That means going to the second tab of the master file entry screen, checking Federal Candidate and entering the Candidate ID number (begins with H, S or P --- not the committee ID, which begins with C00), name, state, district and office sought.

Use the appropriate entry method:

1. Direct cash payment to a vendor. Entered as an in-kind disbursement (above) on Line 24. With the disbursement item is in the entry area, click Log and then Candidate Info. Call up the candidate's name or committee; the candidate info should auto-fill. Then Save.

2. Expenditure before payment is made. This is largely the same as a debt entry. Enter the transaction to the appropriate vendor. Enter the Type as DB and the Line Number as 24. Click Log and then Candidate Info. Call up the candidate's name or committee; the candidate info should auto-fill. Then Save.

3. Payment of a previously-incurred debt or payable. Same as a repayment of a debt. Enter a disbursement to the same payee to whom the debt was posted. Enter the appropriate type and check number. The Line Number is 24. In the Apply To section, use the F3 key or the up/down arrows to find the debt. Save it. (No need to enter the candidate info; the FEC program will read it from the original entry.